when are property taxes due in will county illinois

Will County Treasurer 302 N. No scheduled or one-time payments will be accepted until the new site opens on.

The Will County Circuit Court Clerk Andrea Lynn Chasteen Home

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

. Has yet to be determined. On November 10 2022 the GovTech online payment website will no longer accept payments for Will County. 173 of home value.

In most counties property taxes are paid in two installments usually June 1 and September 1. Other Ways to Pay. The state average is lower at 173.

Will County collects on average 205 of a propertys assessed fair market. 407 N Monroe Marion IL 62959 Phone. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on.

Payments may be made at the county office building 1504 3rd. Joliet IL 60432 If you prefer to pay in person you can do so at the Will County Treasurers Office. The mailing of the bills is dependent on the completion of data by other local.

Subsequent taxes will only be accepted in office. The property tax rate in Will County Illinois is 205 costing residents an average of 4921 per year. If you have a mortgage your lender will likely pay your property taxes for you and escrow the.

M-F 800am - 400pm. 101 South Main Street. In Will County property taxes are due on June 1st and September 1st of each year.

1 day agoThe fourth and final installment of 2021 Rock Island County real estate property taxes are due Wednesday Nov. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. Now rampant inflation is giving local taxing bodies the power to raise rates by 5.

2019 payable 2020 tax bills are. Are Illinois property taxes extended. Tax amount varies by county.

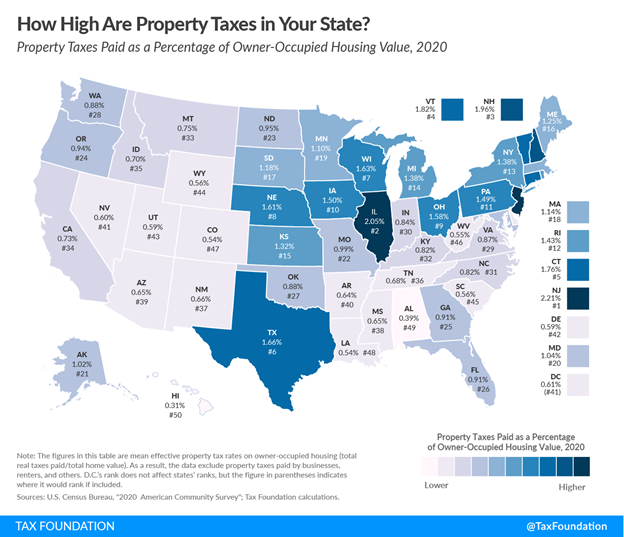

Illinois was home to the nations second-highest property taxes in 2021. Property taxesthey can feel like a. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

Tax Year 2021 Second Installment Property Tax Due Date. Physical Address 18 N County Street Waukegan IL 60085. For now the September 1 deadline for the second installment of property taxes will remain unchanged.

Welcome to the web page of the Christian County Treasurer. Mail your payment to. Chicago Street Joliet IL 60432.

Treasurer Property Tax Bills To Be Mailed Next Week

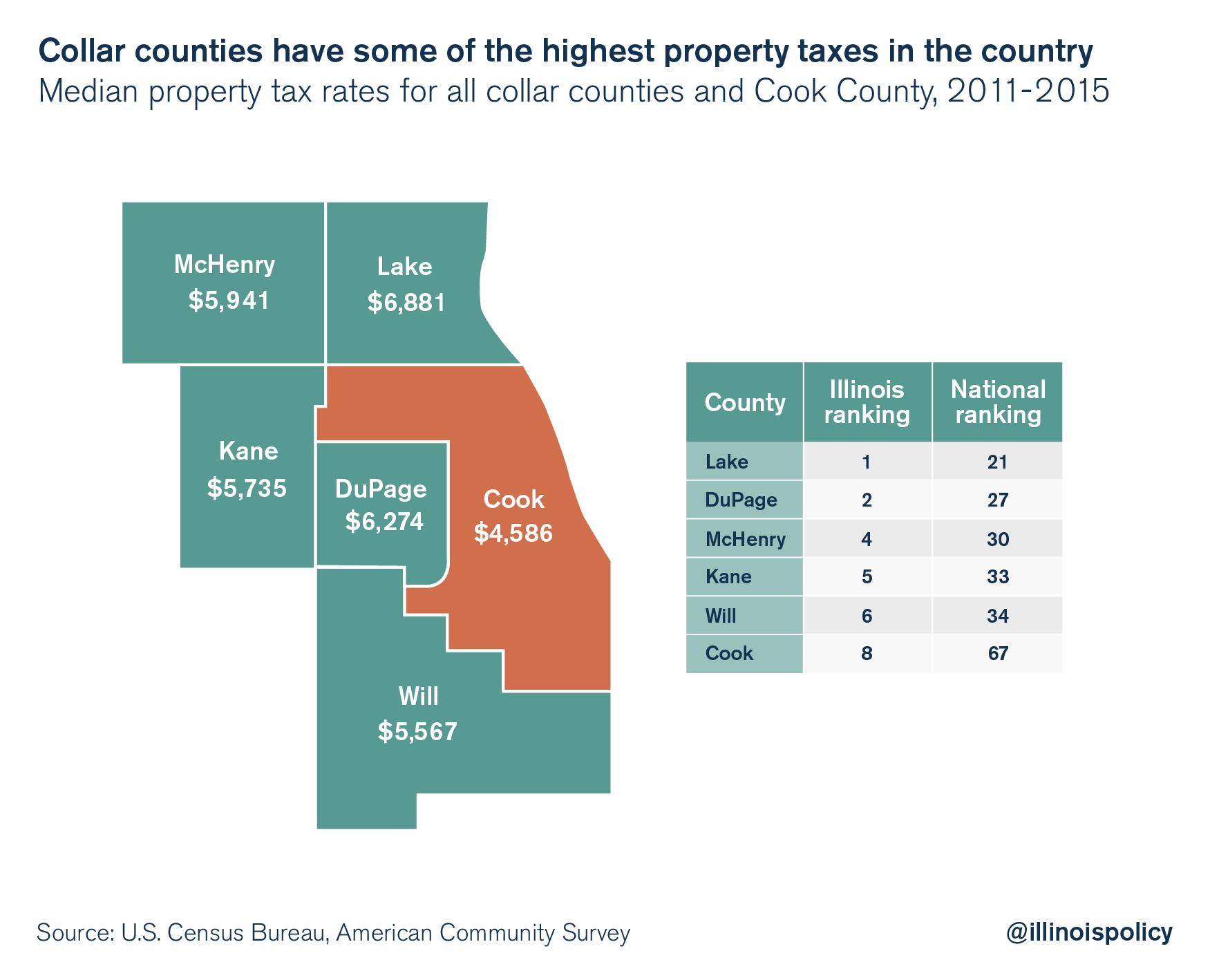

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

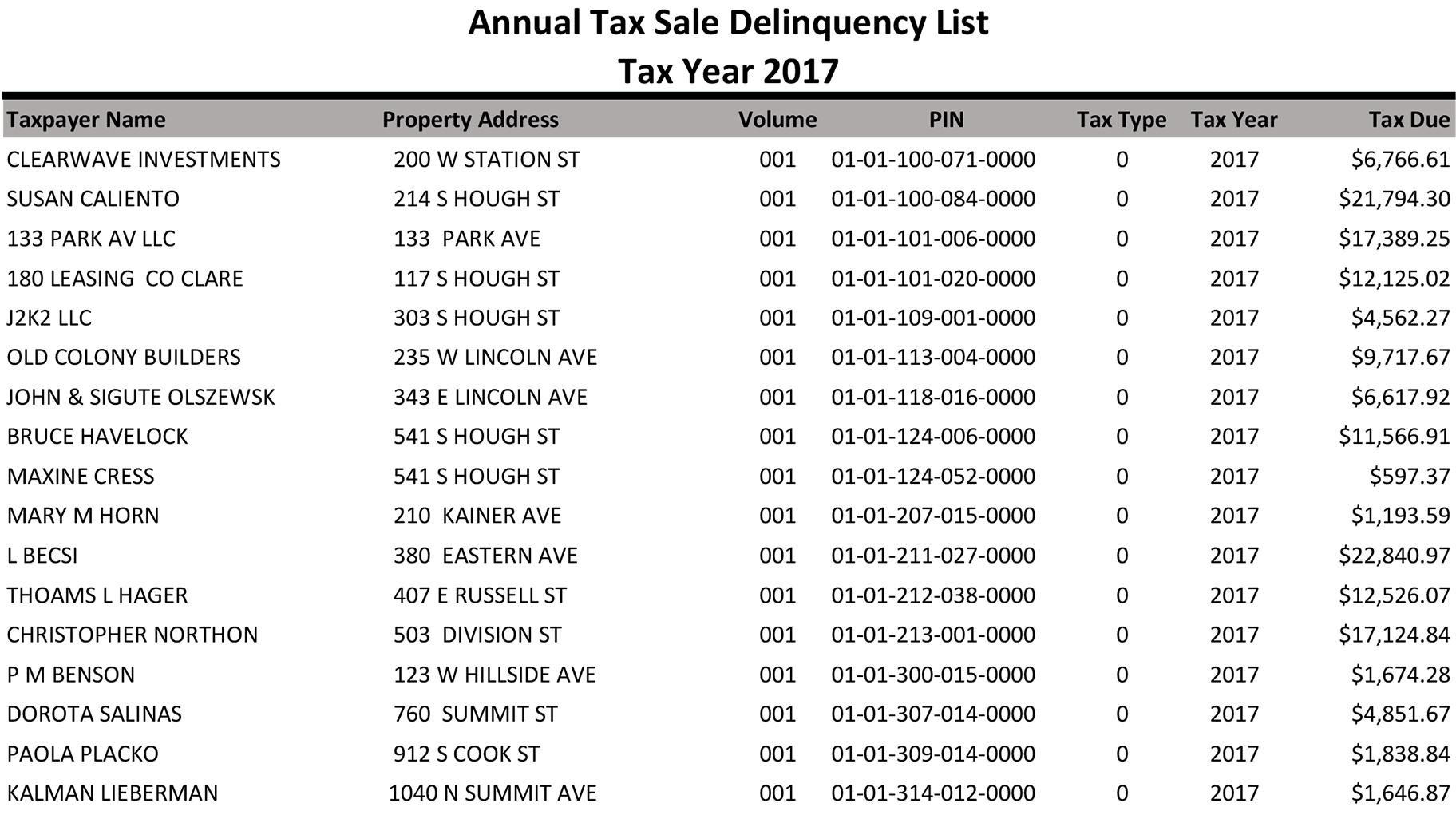

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

Property Tax Calculator Estimator For Real Estate And Homes

Important Tax Due Dates Lee County Il

2nd Installment Of Real Estate Taxes Due Will County Illinois Home

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Current Payment Status Lake County Il

Mchenry County Real Estate Tax Bill

5 5 Acres Of Land For Sale In Romeoville Illinois Landsearch

2nd Installment Of Real Estate Taxes Due Will County Illinois Home

New Report Illinois Property Taxes Among Highest In Nation The Civic Federation